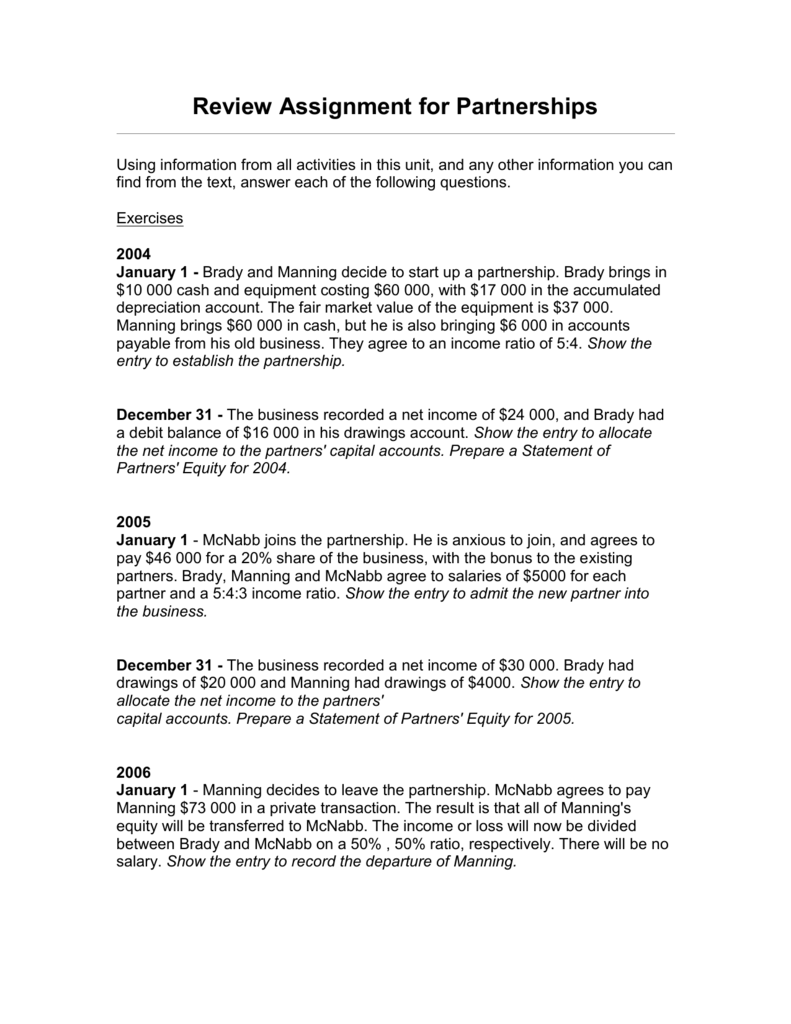

Information On Business Partnerships

Fusiontech Financial Marketing Gesto

/143070814-biz-partners-56a0a41d5f9b58eba4b25d13.jpg)

What Are The Different Types Of Partnerships

/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

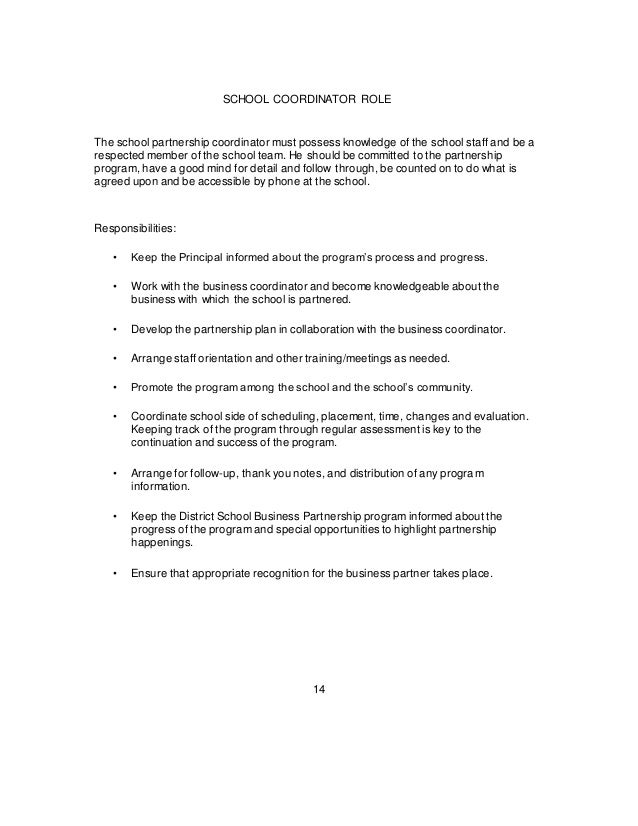

Academy Partnerships Entrepreneurship And Business Academyat Kempsville High School

5 Partnership Termination Letters Free Word Pdf Documents Download Free Premium Templates

4 Types Of Partnership In Business Limited General More

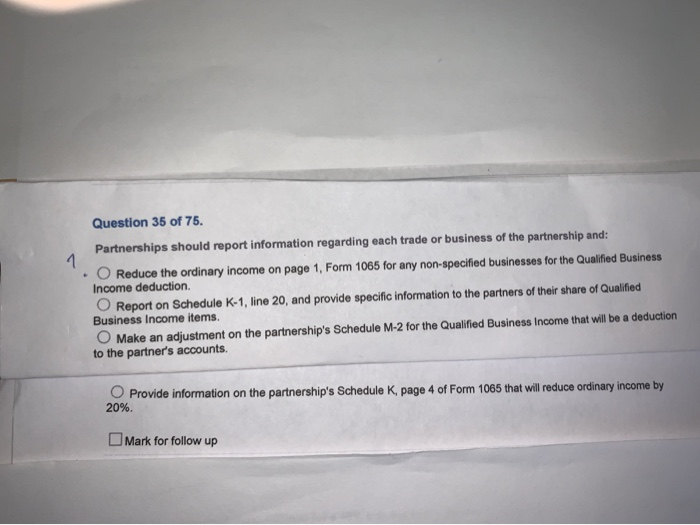

It supplements the information provided in the Instructions for Form 1065, U.

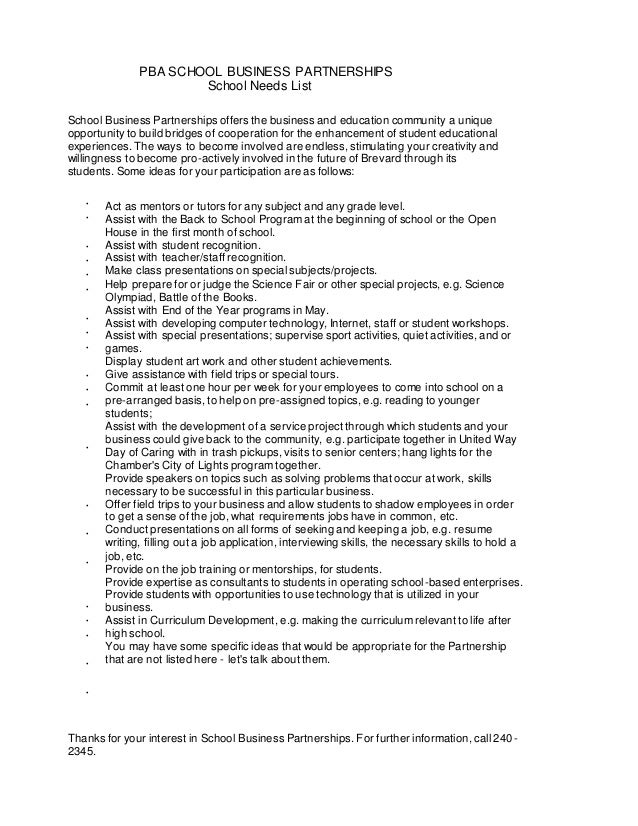

Information on business partnerships. Partnerships can be complex depending on the scope of business operations and the number of partners involved. In return, each partner is entitled to a share of the profits or losses of the business. For partnerships with 50 partners or less, we provide a free online partnership filing application.

Partnerships do, however, need to file an annual information return (Form 1065), also known as a “Partnership Tax Return” to report income, deductions, gains, losses, and more with the IRS. Partners are not employees and should not be issued a Form W-2. Real property interest from a foreign person, the.

A partnership is a business with several individuals, each of whom owns part of the business. It is one of the most common legal entities to form a business. Limited partnership – where liability of debts and obligations for one or more partners is limited.

The partnership is a pass-through entity and the individual partners pay tax on their distributive share of partnership income passed through to. The relationship between the partners, the percentage and type of ownership, and the duties of partners is clarified in the partnership agreement. A partnership is a single business where two or more people share ownership.

For example, if you and a friend or family member decide to set up a business together, you might operate it as a partnership. Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities is limited to the amount they put into the business. Instead, the business “passes through” any profits or losses to its partners.

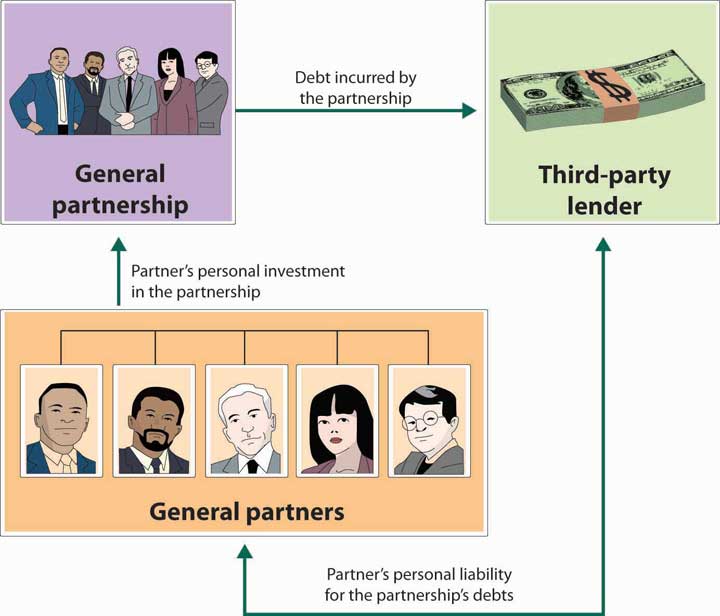

A general partnership is a business arrangement by which two or more individuals agree to share in all assets, profits, and financial and legal liabilities of a jointly-owned business. This publication provides supplemental federal income tax information for partnerships and partners. The partners may be active participants in running the business or they may be passive investors.

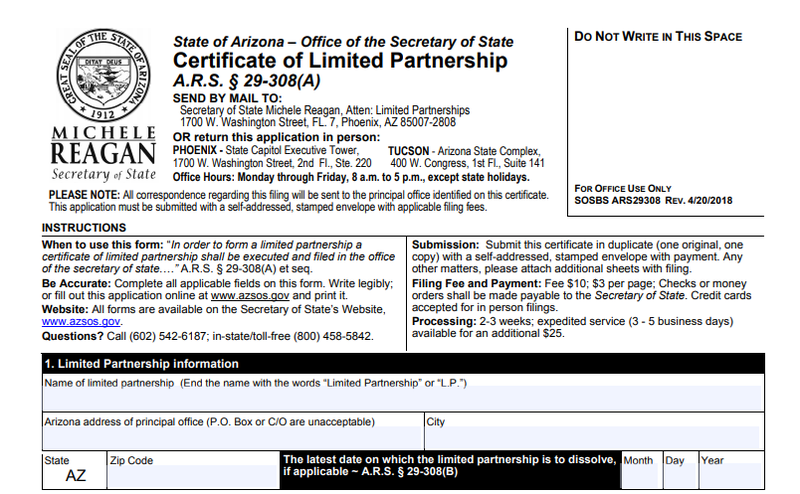

General partnership involves 2 or more general partners who share equal rights and responsibilities in managing the business. All limited partnerships, per A.R.S. A partnership does not pay tax on its income but “passes through” any profits or losses to its partners.

Return of Partnership Income. As Apple has risen to become the world’s most valuable company, its main manufacturing partner, Foxconn, has struggled with low margins. Limited partnerships consist of partners who maintain an active role in the management of the business, and those who just invest money and have a very limited role in management.

In addition to sharing profits and assets, a partnership also entails sharing any business losses, as well as responsibility for any debts, even if they are incurred by the other partner. A partnership is the relationship between two or more people to do trade or business. A partnership's tax year ends on the date of termination.

Use Partner’s Share of Income, Deductions, Credits, etc. A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. Return of Partnership Income, a partnership (U.S.

Visit Resident and Nonresident Withholding Guidelines (FTB 1017) and the Small Business Withholding Tool for more information. Publication 541, Partnerships, has information on how to:. Or foreign) with foreign partners could be responsible for complying with other filing requirements such as Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), Partnership Withholding, and NRA Withholding.

In a partnership each person contributes to all aspects of the business, sharing the profits and losses of the business as well. A partnership is a group or association of people who carry on a business and distribute income or losses between themselves. If a partnership acquires a U.S.

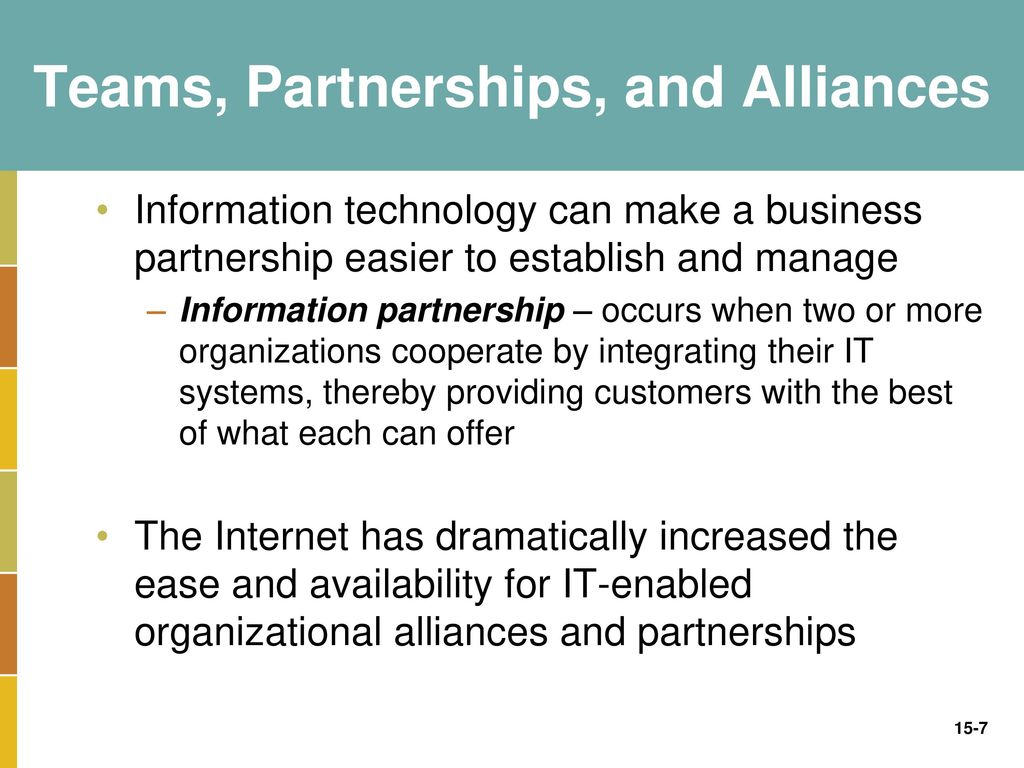

The success of one company depends on the success of the other. NJ-1065 filers that have ten or more partners are required to file by electronic means. Finally, partnerships aren’t for everyone.

Foxconn has tried a variety of tactics to boost its profits, including charging Apple for workers it never used and taking shortcuts on component and product testing, ex-Apple and Foxconn managers said. Ensuring the security and resilience of the nation’s critical infrastructure is a shared responsibility among multiple stakeholders because neither government nor the private sector alone has the knowledge, authority, or resources to do it alone. Partnerships are registered with a state, and there can be several different types of partnerships, depending on the profession of the partners and the wishes of the owners for management responsibility and investment.

This can place a burden on your personal finances and assets. The three forms differ. An association of two or more persons engaged in a business enterprise in which the profits and losses are shared proportionally.

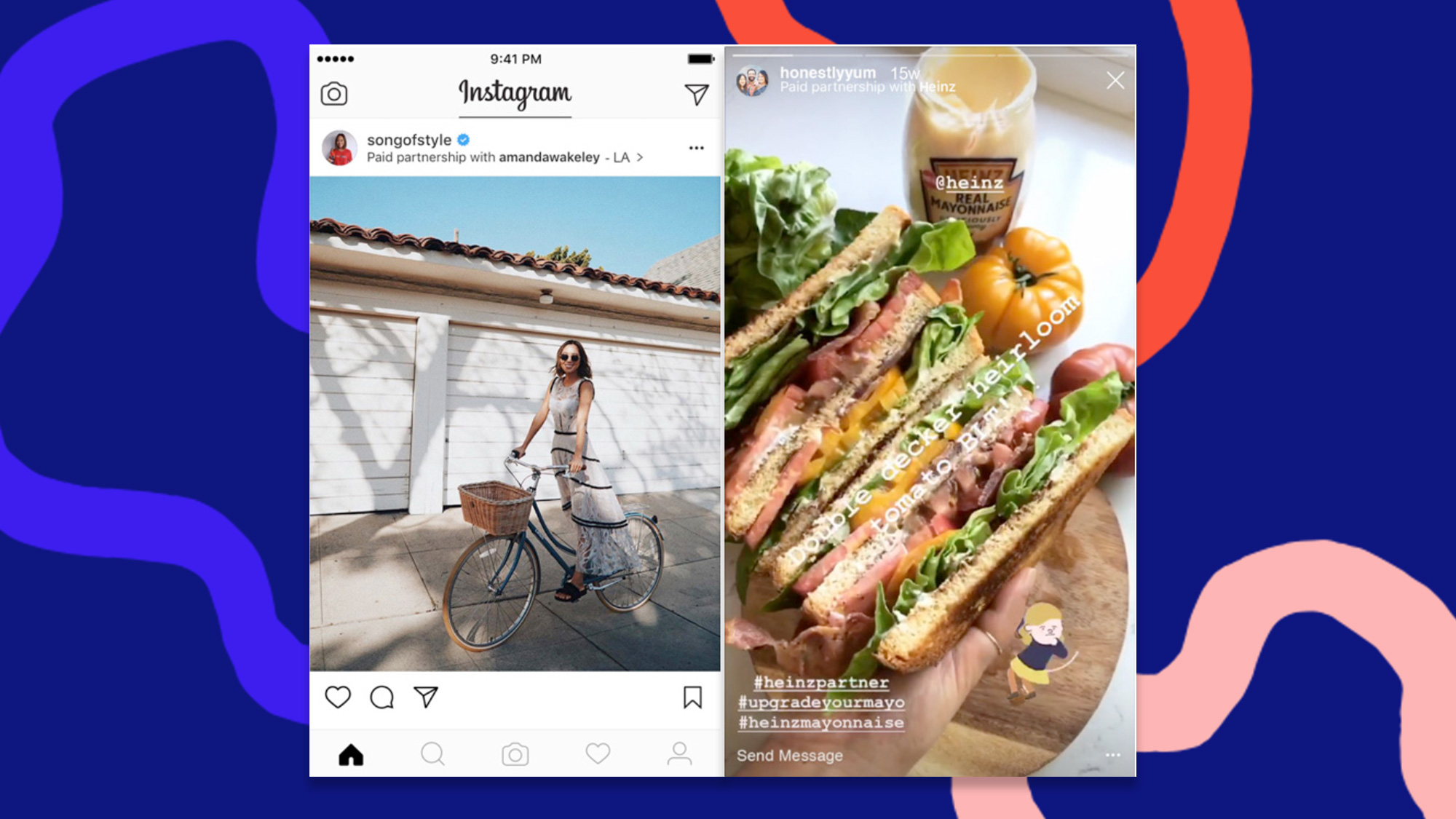

An additional requirement for partnerships is that they must file an “annual information return” to report the income, deductions, gains and losses from the business’s operations, but the business itself does not pay income tax. One type of partnership is co-branding, which is an advertising partnership and strategic marketing that exists between two brands. Professionals like doctors and lawyers often form a limited liability partnership.

In its most basic sense, a partnership is any business or institutional association within which joint activity takes place. For example, a limited company counts as a ‘legal person’ and. Each partner contributes money, labour, property, or skills to the partnership.

In a general partnership company, all members share both profits and liabilities. A domestic limited partnership may change its name, the names of its general partners or the name and/or address of its agent for service of process by filing an Amendment to Certificate of Limited Partnership ( Form LP-2 ). A legal form of business operation between two or more individuals who share management and profits.

A partnership consists of two or more people or entities who carry on a business and distribute income or losses between themselves. A PPP exists from the moment one or more public organizations agree to act in concert with one or more private organizations. There are three forms of partnerships:.

All partners in a general partnership are responsible for the business and are subject to unlimited liability for business debts. Public-private partnerships are the foundation for effective critical infrastructure security and resilience strategies, and timely, trusted. There are 2 common types of partnerships:.

The LLP has no estimated tax. There should be a description of each partner’s responsibilities and. Generally, a partnership is a business owned by two or more individuals.

General partnership, joint venture, and limited partnership. A partnership is an association or relationship between two or more individuals, corporations, trusts, or partnerships that join together to carry on a trade or business. Key Takeaways A partnership is an arrangement between two or more people to oversee business operations and share its profits and.

Visit Partner’s Instructions for Schedule K-1 (565) for more information. A partnership is a business form created automatically when two or more persons engage in a business enterprise for profit. A partnership continues for tax purposes until it terminates.

29-301(7), two or more persons under the laws of this state and having one or more general partners and one or more limited partners. However, partnerships are required to file annual information returns with the IRS on Form 1065, U.S. The legal definition of a partnership is generally stated as "an association of two or more persons to carry on as co-owners a business for profit" (Revised Uniform Partnership Act § 101 1994).

A partner does not have to be an actual person. Partner roles in signing and authorizations. The partnership will report any information you need to figure the interest due under section 1260(b).

A partnership arises whenever two or more people co-own a business and share in the profits and losses of the business. A partnership involves 2 or more persons who run a business as co-owners. If you desire to conduct business as any limited partnership, you must file with our office to receive that designation.

We have already created and registered hundreds of thousands of birth records. A General Partnership (GP) is an agreement between partners to establish and run a business together. Partners must include partnership items on their tax or information returns.

Other business legal structures include sole proprietorships, limited liability companies (LLCs), corporations, and nonprofit corporations. Family partnership – where two or more partners are related;. 6, /PRNewswire/ -- Ready Computing, a leader in healthcare IT services and solutions, is proud to announce its Information Builders partnership Information Builders, which has.

Each person contributes money, property, labor or skill, and shares in the profits and losses of the business. If the partnership had gain from certain constructive ownership transactions, your tax liability must be increased by the interest charge on any deferral of gain recognition under section 1260(b). The partners invest their money in the business, and each partner benefits from any profits and sustains part of any losses.

Unlike a corporation, which typically issues stock, the partners share directly in the profits and losses of the business, depending on their percentage. Have a very clear understanding of what the managers or officers of the business are authorized to do. A business partnership does not pay taxes on income.

The partners in a partnership may be individuals, businesses, interest -based organizations, schools, governments or combinations. 7 The partnership must also prepare a Schedule K-1 to give to each partner, showing that partner's distribution of the taxable profits or losses of the partnership for that year. Duties and responsibilities of each partner.

The two most common. Having business partners means. A partnership can be a:.

The VIP aims to streamline and integrate all vital registrations across the Commonwealth. Partners share the business’s profits, and each partner pays tax on their share. If you’re looking for more information on how to start a business partnership, the Small Business Administration has some great resources.

Vitals Information Partnership (VIP) The Department of Public Health (DPH) streamlines all vital event registration through the VIP. This can be a good way to get into new markets, build more business, and increase awareness. In addition to the filing of Form 1065, U.S.

Limited partnership involves at least one general partner and limited partner (s). Name of the partnership:. They can take advantage of new channels of distribution or.

(Corporations Code section .02 .) Form LP–11 should not be used. There are several different types of partnerships, and you can include the type in your partnership's name, including the name the partnership is doing business as (if different).;. It may be the office of the chief executive officer or the office of a registered agent.

The federal government recognizes several types of partnerships. Consider the following language from the Uniform Partnership Act:. A business partnership is a legal relationship that is most often formed by a written agreement between two or more individuals or companies.

To reduce the potential for complexities or conflicts among partners within this type. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Joint ventures are the same as general partnerships except that the partnership only exists for a specified period of time or for a specific project.

For more information on partnerships, visit Partnership Information. The principal office is the place where documents are delivered. Basically, you may be responsible for decisions your partner makes in connection with the business.

Setting Up the Partnership. The structure of how many people make up the partnership and their individual responsibilities breaks down into three subcategories. There are many partnership business examples.

The Business Entities Section of the Secretary of State’s office processes filings, maintains records and provides information to the public relating to business entities (corporations, limited liability companies, limited partnerships, general partnerships, limited liability partnerships and other business filings).

Corporate Nonprofit Partnerships In The Land Of Impossible Expectations The Alford Group

5 Types Of Strategic Partnership Agreements W Real Examples

Sandia National Laboratories Working With Sandia Technology Partnerships

Jari Industry Partnerships Jari

Types Of Business Partnerships Breaking Down The Options

Business Partnerships Baseline Report

40 Free Partnership Agreement Templates Business General

3

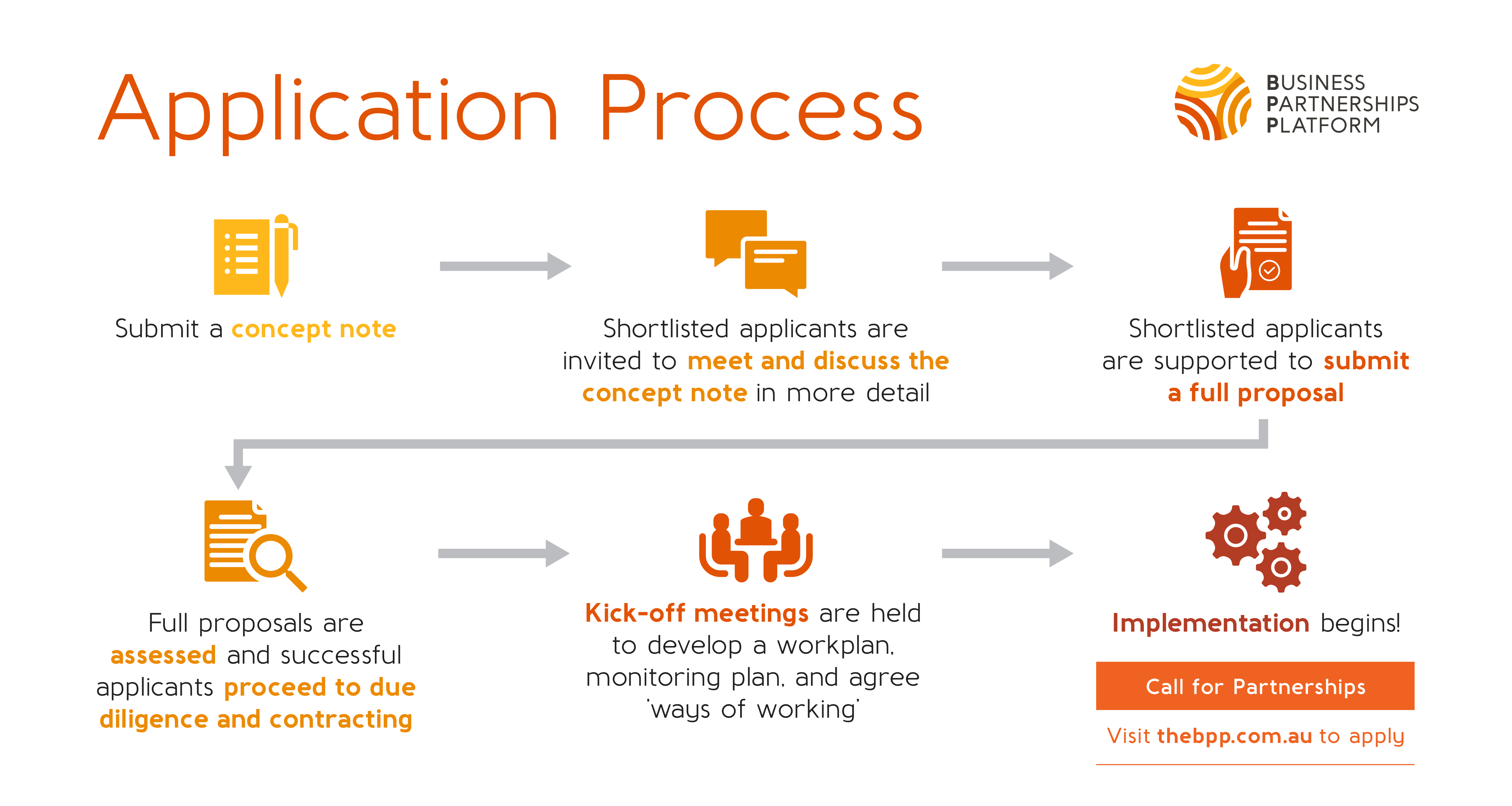

Dfat Bpp Round 1 Partnerships Announced Round 2 Now Open Shared Value Project

:max_bytes(150000):strip_icc()/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

How To Legally Form A Partnership In A Guide The Blueprint

Http Www Education Vic Gov Au Documents School Principals Community Businessprtnrshp Pdf

Business Partners For Sustainable Development Uscib

Business Partnerships Wegate European Gateway For Women S Entrepreneurship

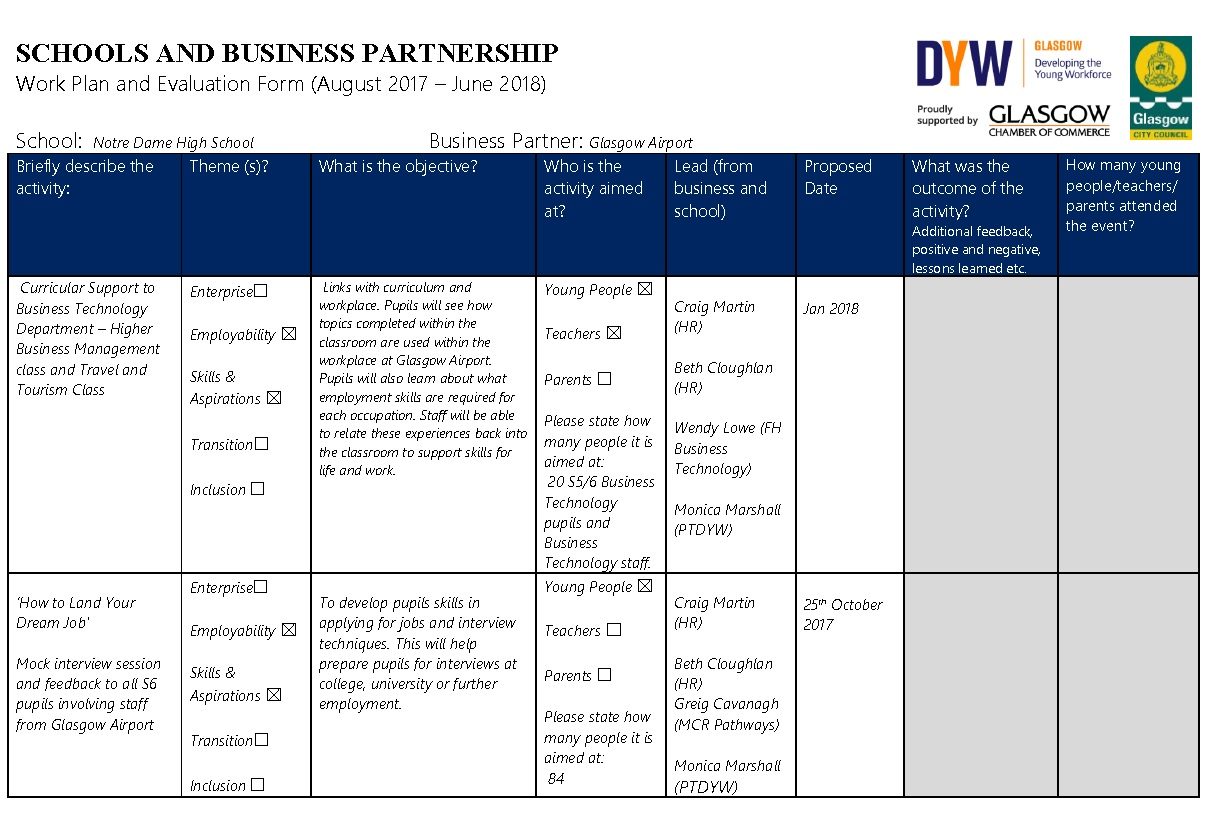

Developing School Business Partnerships Converted

3

2

School And Business Partnership Plan 17 18

Creating Collaborative Partnerships Ppt Download

Cbo Business Partnership Info Session Webinar Lancaster County Community Foundation

Business Partnerships Join Cumberland Cape Atlantic Ymca

Business Services Organization For International Economic Relations

2

Types Of Partnerships In Business Alvernia Online

Checklist

File

:max_bytes(150000):strip_icc()/shutterstock_318541115-5bfc3d8446e0fb00260f9c1c.jpg)

Partnership Definition

Information Technology Archives Lma Consulting Group

Sri Lanka Australia Calls For Inclusive Business Partnerships In Sri Lanka To Help Covid 19 Recovery

Form 1065 Instructions Information For Partnership Tax Returns

Business Partnerships By Regions Europe Us Powerpoint Presentation Tips Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates

1

Free Partnership Agreement Create Download And Print Lawdepot Us

Business Next Level Services

4 Types Of Partnership In Business Limited General More

Business Entities California Secretary Of State

How And Why To Use The Paid Partnership Feature On Instagram Business 2 Community

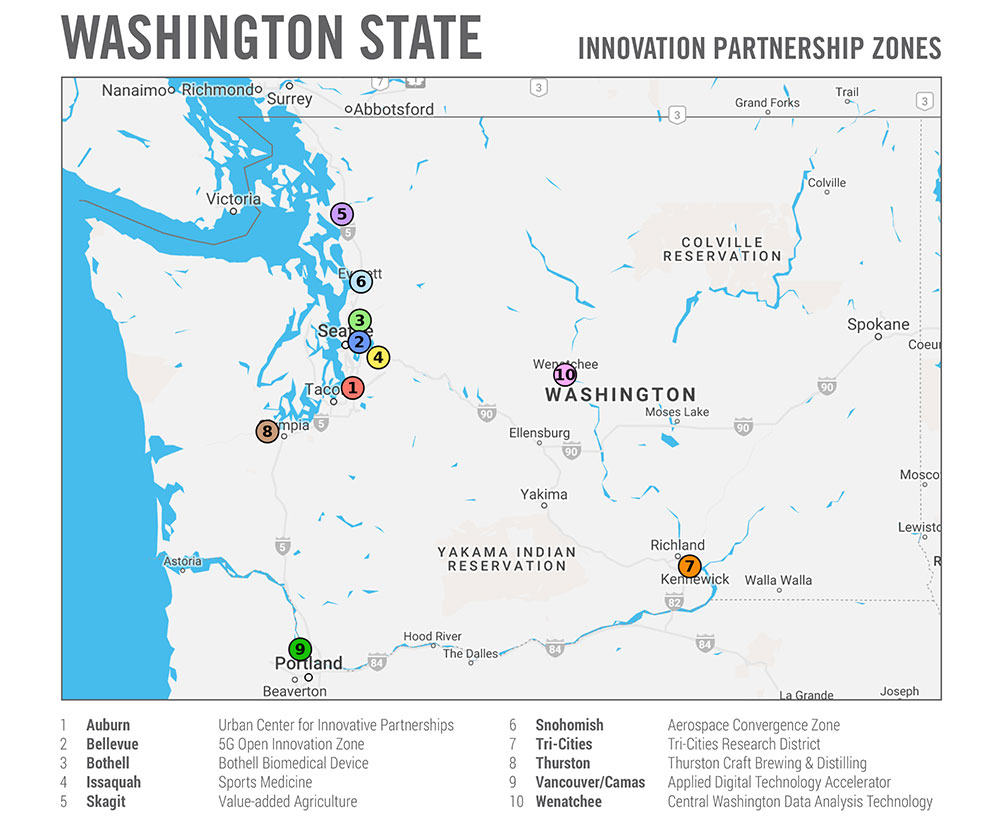

Innovation Partnerships Zones Pathways To Business Growth In Washington State

Strategic Analysis Inc Small Business Partnerships

General Partnerships Advantages And Disadvantages

Qualified Joint Ventures As Partnerships Joint Venture Agreement Venture

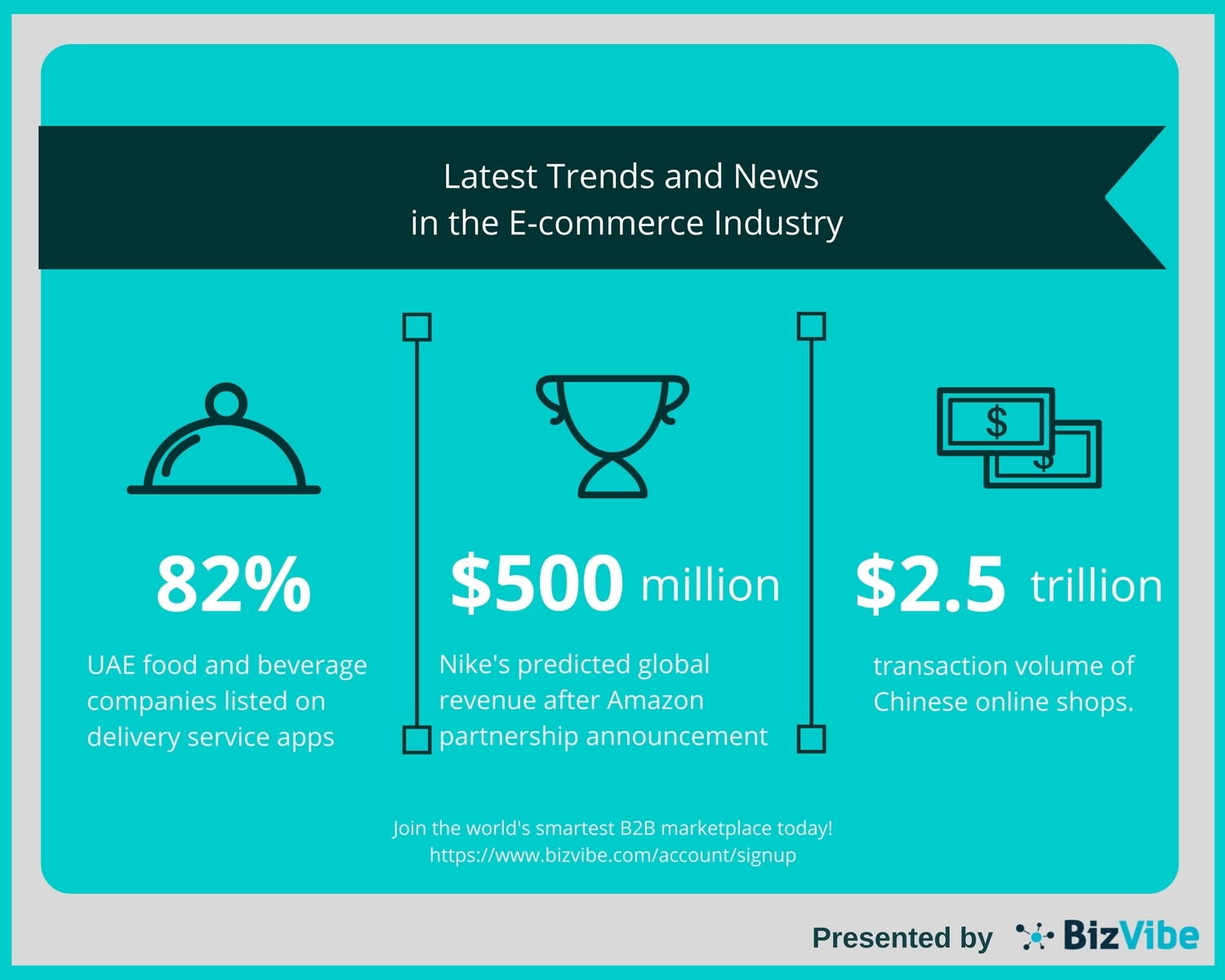

New Partnerships And Business Ventures Leading To Rapid Growth Of E Commerce Worldwide Business Wire

Bpp Announces Call For Partnerships To Support Covid 19 Recovery

2c Your New Business Choosing The Right Legal Structure Partnerships General Partnership Business Tips Business

Information Leaflet Business Partnership Facility Kbf Africa

Public Private Partnership Wikipedia

21 Examples Of Successful Co Branding Partnerships And Why They Re So Effective

Reading Sole Proprietorship And Partnerships Introduction To Business

/GettyImages-515028375-59b1490faad52b0010f48e9c.jpg)

How To Start A Partnership In 7 Easy Steps

Limited Liability Partnerships Reports Acra

Partnership Rules Faqs Findlaw

Tools For Building Business Partnerships Kmu Business

Business Charity Partnerships Sussex Cancer Fund

Partnerships General Information

Partnership Agreement Template Create A Partnership Agreement

Information Service Excellence Through Tqm Building Partnerships For Business Process Reengineering And Continuous Improvement Braithwaite Timothy Amazon Com Books

Solved Question 35 Of 75 Partnerships Should Report Info Chegg Com

Free Partnership Agreement Create Download And Print Lawdepot Us

Bpp Samoa Call For Partnerships

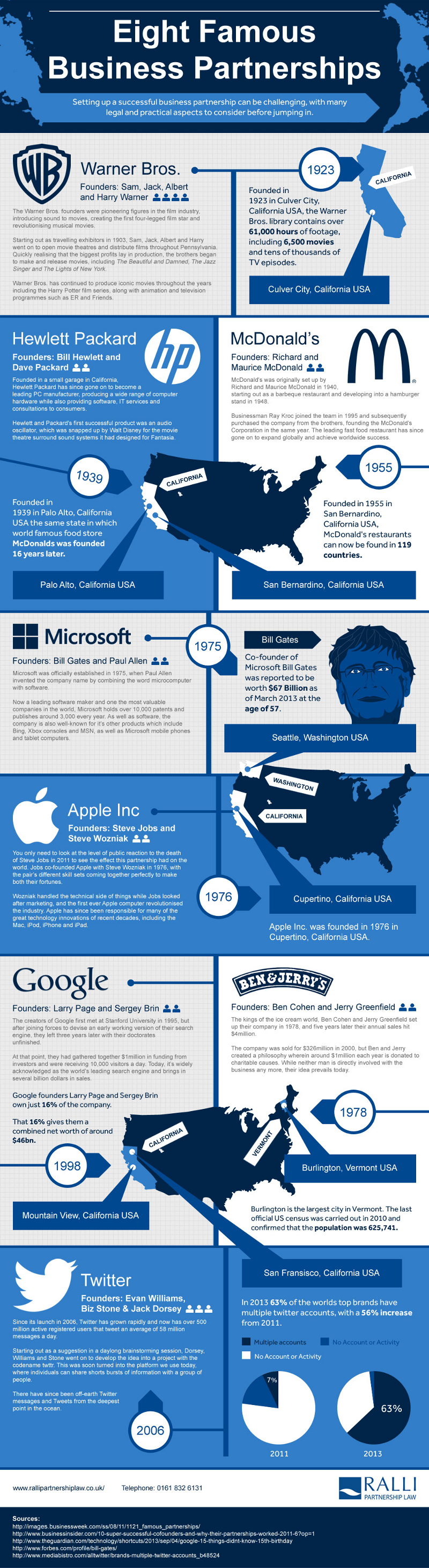

8 Famous Business Partners And Their Stories Brandongaille Com

Business Partnerships Platform Home Facebook

How To Start A Partnership Lp Llp Lllp Gp In Mississippi Ms Secretary Of State Start Your Small Business Today

Valuable And Unique Essays On Business And Arts Partnerships Americans For The Arts

Private Sector Partnerships And Citizen Collaboration Could Bridge Gap Between Government Technology Investments And Service Challenges Accenture Report Finds Business Wire

7 Tips For Making A Business Partnership Work

Collaborating For The Common Good Navigating Public Private Data Partnerships Mckinsey

Friends Of Utah State Parks Business Partnerships

All Master Partnership Network Components Of An Effective Business Model

Improving The Management Of Complex Business Partnerships Mckinsey

How To Handle Partnership Tax Returns Picnic S Blog

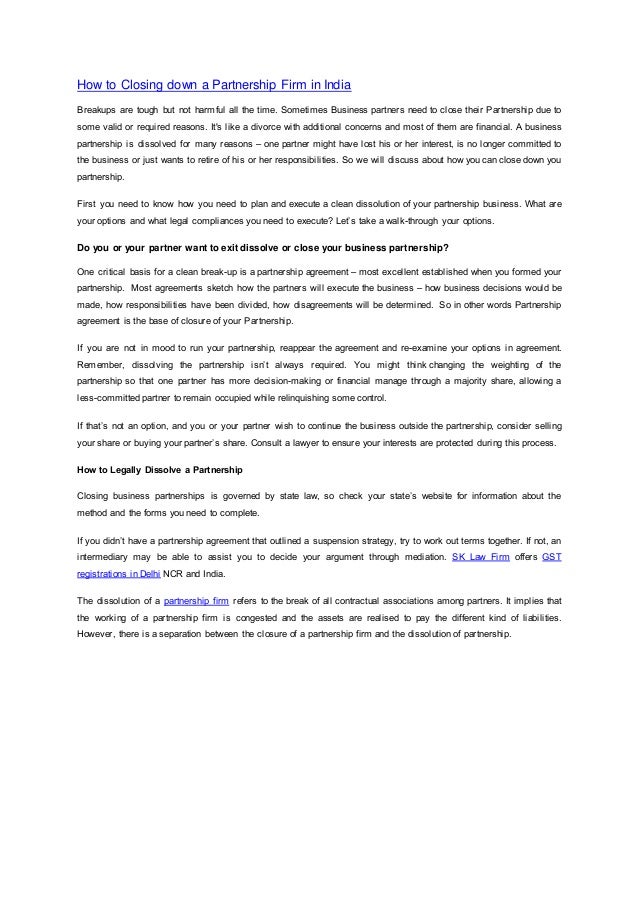

How To Closing A Partnership Firm

Business Partnerships Platform Home Facebook

/what-is-a-business-partnership-398402_FINAL-8e4214edc68b470d9c596d128f6ffeac.png)

Business Partnership What Is It

Amazon Com How To Grow Your Business With Joint Venture Partnerships Information For Intermediates Ebook Mullally Joan Michaels Thomas Kindle Store

Business Partnerships Symphony Nh

8 Famous Business Partners And Their Stories Brandongaille Com

Business Partnerships The Good The Bad The Ugly Hia Li

About Us Partnerships

About Partnerships John A Sanchez Company

Developing School Business Partnerships Converted

What Is Form 1065 Partnership Tax Return Guide

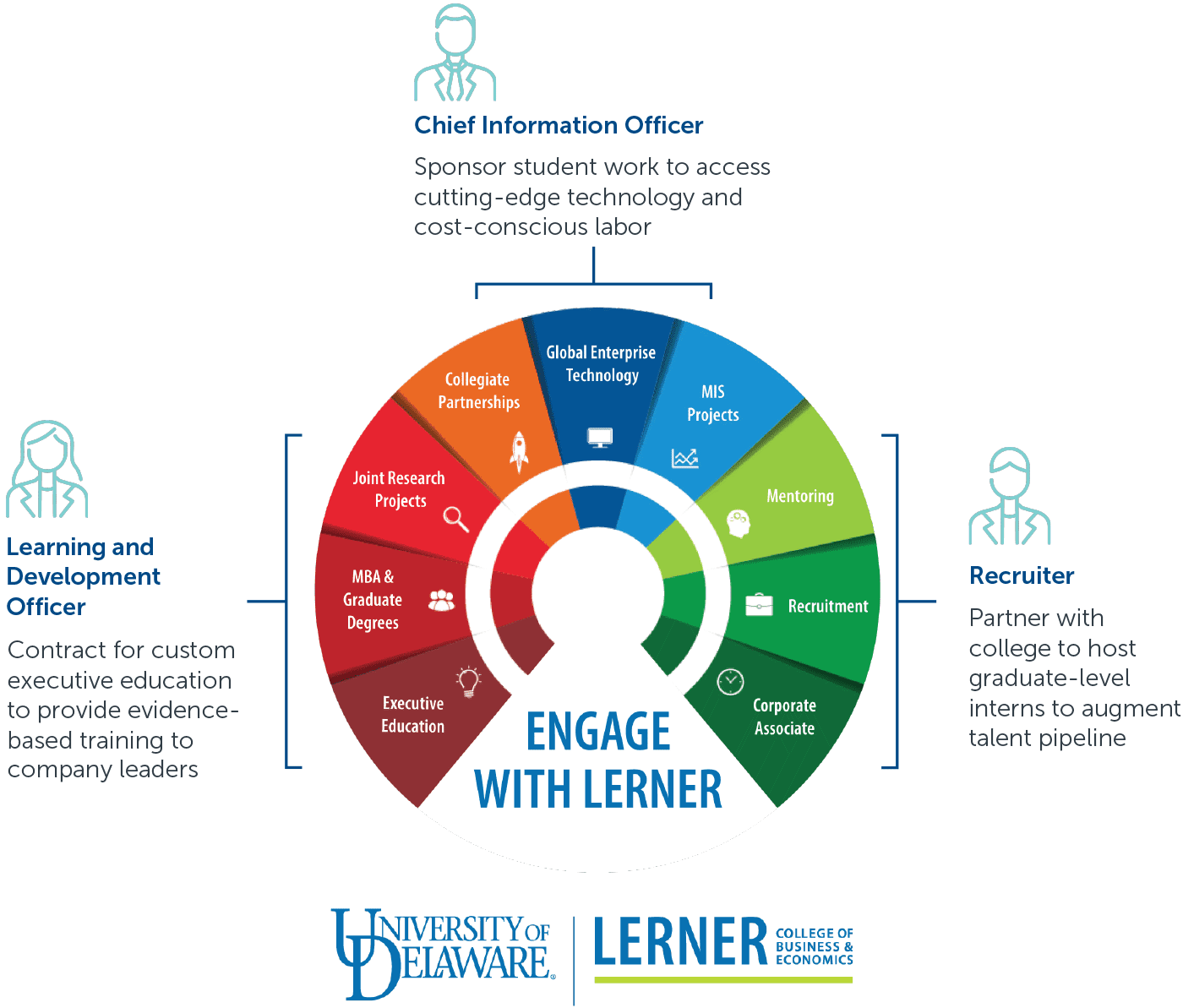

Create The Infrastructure To Support Employer Partnerships Eab

.png)

The Types Of Businesses M Ross Associates Llc

Developing School Business Partnerships Converted

6 Strategies To Build Links To Your Small Business Website

Read Partner Proofing Your Partnership Online By Brett Cenkus Books

Ppt Drs Hans Pruim Chief Business Partnerships And Information Services Powerpoint Presentation Id

Bpp Samoa Call For Partnerships Information Session Youtube

Aerospace Industry Profile Alabama India Business Partnerships

Q Tbn 3aand9gcsi B Ehxudtwot2nbq0tbtpiqojlqkqosdbvrggyf2n702pfvx Usqp Cau

Partnership Agreement Template Create A Partnership Agreement

Advantages And Disadvantages Of Business Partnership

Business Partnerships California Supreme

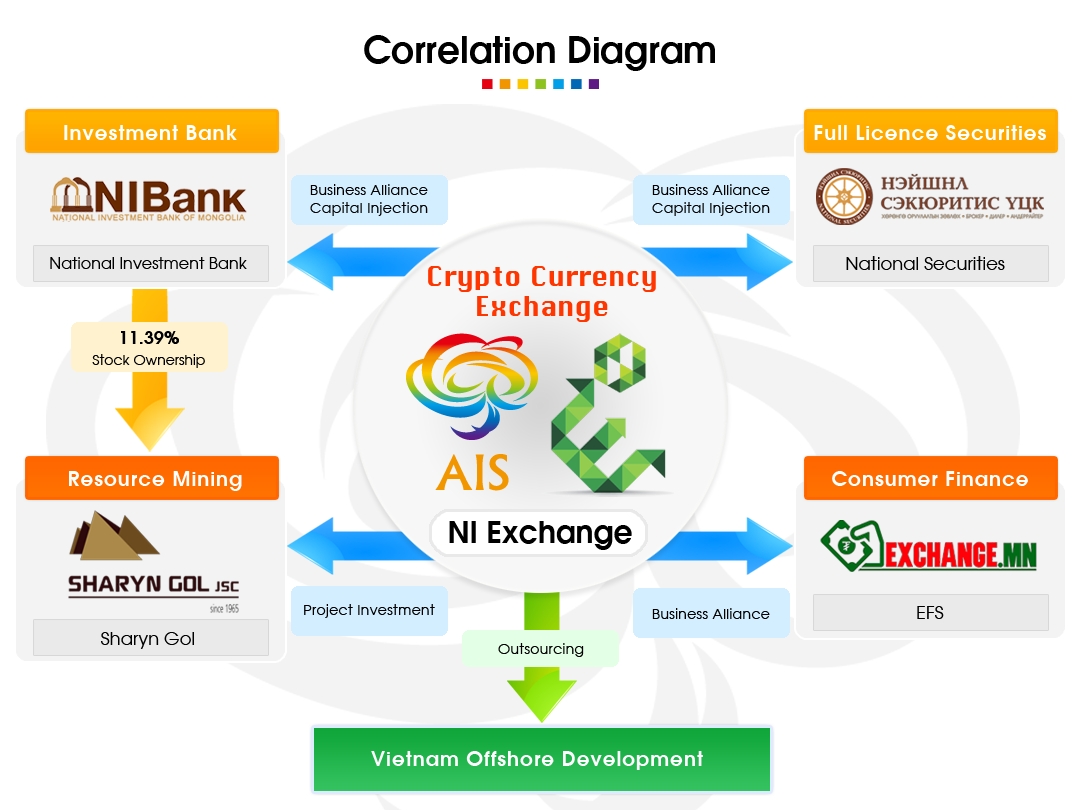

Mongolia S Cryptocurrency Exchange Ais X Establishes Business Partnerships With Local Financial Institutions Starting Operations As An Integrated Financial Service From March 19 Business Wire

/shake-on-it-3240098-c3e83f2455b7409ca9a5d6ae5ce0e673.jpg)

Partnership Definition

2

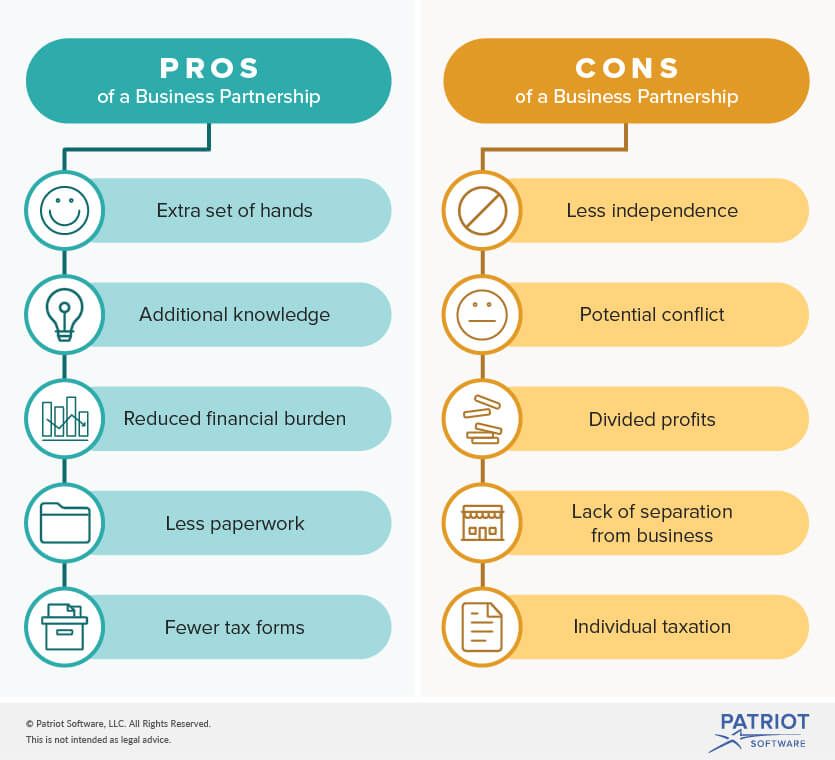

Pros And Cons Of A Partnership Considerations Before Structuring

Culturalcorridor Org Wp Content Uploads 19 05 Icca Partnership Benefits And Responsibilities 19 Pdf